An effective tool in trading should enable you to make money from the markets or at least improve your risk management.

One of the most popular technical indicators that you will certainly have heard of, is the Stochastics indicator.

Here I will do a preliminary test into how well the stochastics indicator still serves as an effective signal to buy or sell in the markets.

According to this Investopedia article, it was developed by George Lane somewhere in the 1950s.

The stochastics indicator identifies when a market is oversold or overbought.

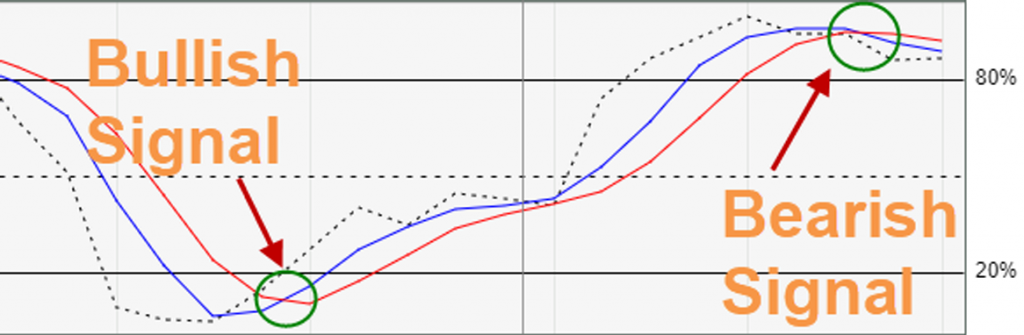

In the version of this indicator I’m using, there are 3 distinct lines, the %D, %K and smoothed %D line.

There are many ways to use this indicator, so I’m going to use the crossover between the %D and smoothed %D lines to trigger my entries.

I decided that valid bullish crossover signals should happen below the 20 level, while valid bearish crossover signals should happen above the 80 level.

Then we will buy or sell on the next candle’s open.

Here’s a picture describing an example of the bullish and bearish signals:

(Red line = Smoothed %D, Blue line = %D)

Armed with my Stochastics indicator on a default setting of (14,3,3), I took a walk onto the US equities battlefield… and found some interesting results.

The companies are Tesla, Ford and Coca-cola

These test are conducted on the weekly chart from about 2014 to about the middle of 2019

My expectations going into this are:

- that it would work well on more volatile counters which don’t trend often.

- As a very simple entry and exit signal, I don’t expect it to be profitable.

- I don’t expect too many signals as well since it is based on a weekly chart.

And the results are below.

Tesla:

Ford:

Coca-cola:

I’ve made a few observations about potential ways in which we can improve the performance of using stochastic indicator in our trading.

A few of my observations are:

- Implementing a logical SL and TP will likely improve performance

A lot of the trades would move in the favour in the initial part of the trade. So overall results can be improved by implementing a logical SL and TP and even some trade management where the stop loss is pushed up. - Signal quality can potentially be improved.

Based on my visual observations, including the %D crossing above or below the 20 and 80 levels as a trigger, might actually help improve the accuracy of the entries. - Perhaps using a moving average to help trade with the shorter term trend might help.

Another thing which can be done, is filtering the instances where the short term trend is not in favour of the trade. - Good trades tend to work out quickly.

The longer a trade is held, the less likely it seems to work out profitably.

I did a rough test on 5 random popular large cap stocks, and these are 3 of the positive results.

That’s a surprisingly good hit rate!

If we went to do this backtest on 100 stocks, how many stocks do you think it would work on?

Among the 100 stocks, do you think we can identify similarities in stocks where it would work well on?

There is, of course, a lot more research which can done and from many different angles.

But a preliminary observation like this, does seem to suggest that our common stochastic indicator can still pull in the dollars from the markets.

The key might lay in identifying what type of volatility we can apply it in and a pinch of basic risk management goes a long way.

If you delve deeper into this, do share your thoughts or results.

Good trading!