Have you guys tried the new McDonald’s salted egg yolk burger? I hear it’s a total bust! But Mcdonald’s has the right idea though, it’s getting on a trend here in Singapore. Recently, Singaporeans have gone crazy over salted egg yolks. I recall it began with the salted egg yolk buns sold at various dim sum restaurants. Then it became salted egg yolk croissants. Then I see it on shrimp. And chicken. And now.. a burger.

So perhaps the execution left much to be desired, but McDonald’s had the right idea to get on this prevailing trend. Nevertheless, I’m enjoying this trend, mostly anyway. I can’t wait to see what else they throw salted egg yolks on! Ice cream? Hot dogs? Lobster? Oysters?

Update: a day after I post this, I see an article on salted egg yolk dishes in Singapore by a famous food blog and there really is salted egg ice cream!

Just like us trend or swing traders, even day traders, we should always position ourselves with the existing trend. Internalizing that is easier said than done. Observe the Oil segment below for an example of the struggles we face.

But first, some BREXIT action!

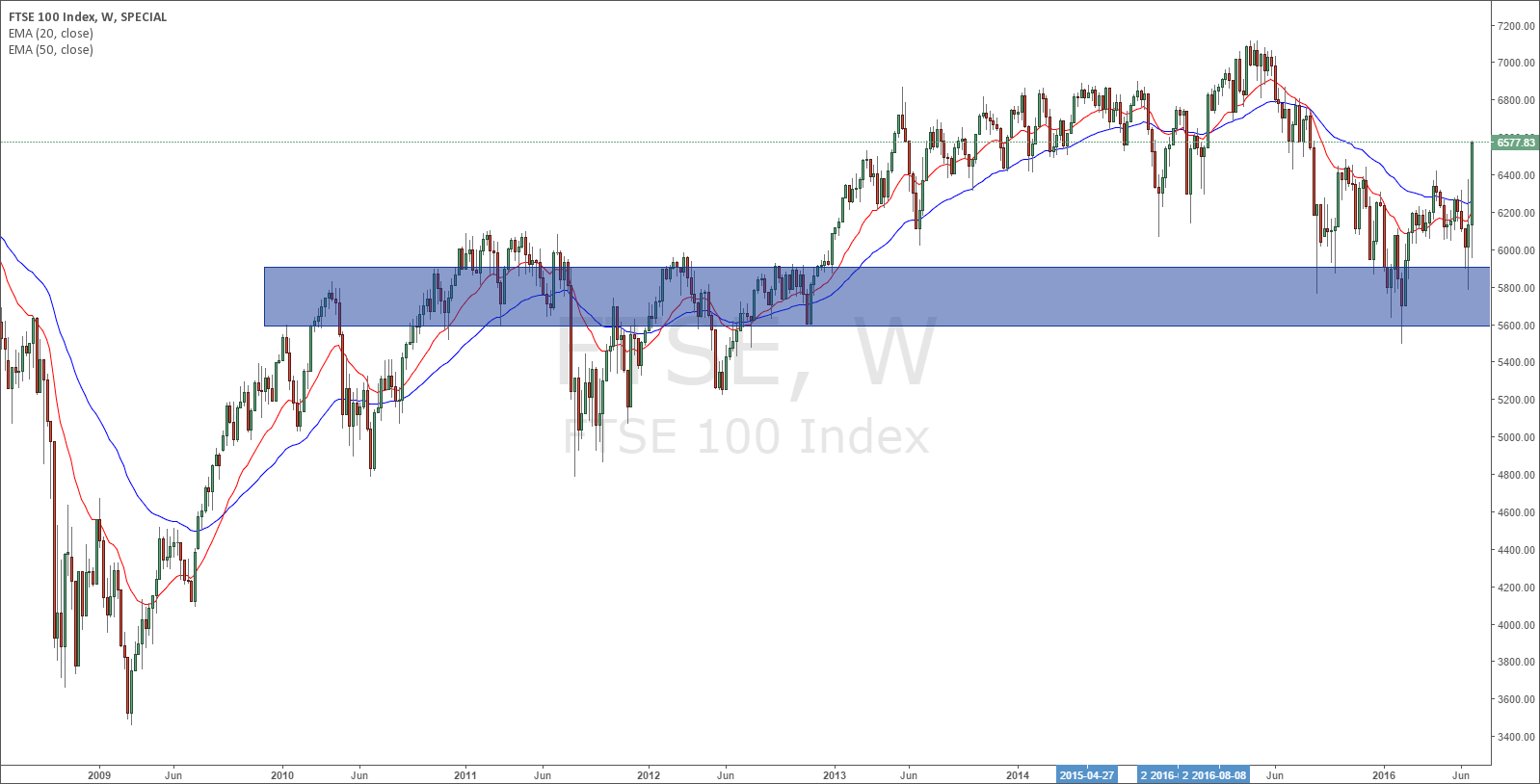

FTSE has jumped up, cleared previous highs, euro stoxx 50 has only covered back about half the losses. Bond yields are agreeing this sentiment with further drops in yields. What’s going on?

Bad news

- UK voted to leave the EU

- UK has 47% of it’s exports going to the eu, down from 60% a decade ago, but 47% is still a significant part of their exports.

Update: Relax, this doesn’t mean UK will lose 47% of its export volume, it just means a huge portion of UK’s exports will be subjected to new trade terms when/if Britain leaves.

The currently bleak situation

- Right now UK has a lack of leadership. After David Cameron resigned after the brexit vote, the favourite leader of the Leave campaign suddenly isn’t stepping up to take up the empty seat which Cameron vacated.

- Prior to the vote, markets were pricing in at most a 50% chance of leaving the EU, largely the markets were pricing in a Stay result. Meaning markets were not trading that low. After the Leave result was announced, markets tanked in a scramble to price in the unexpected result.

Is everything really as bad as it seems?

In the face of all this bad news, with the prior high being priced for a Stay rather than a Leave, how can the markets be rallying even higher than before?

- The belief is that UK will not activate article 50 so soon, so their 2 year count down to leave has not yet started. You can read about Article 50’s terms here.

- This means business as usual for the moment.

- Also the future is looking brighter for UK trade with global partners, coming out of the eu, UK is able to negotiate its own deals with other trade partners. Something which the EU has failed miserably at.

Does it really matter whether or not the situation is as bad as it seems?

Fundamentals at this point are all speculation, maybe in 3 years time, we’ll look back and then we’ll see the real reason for why the markets rallied after the Brexit Leave vote.

It could simply be manipulated markets, a last rise before a downtrend resumes. Or an overreaction, with liquidity now above the market instead of below.

All these news and speculative rumours, won’t make you money.

Collin highlighted the divergence between the FTSE and Eurostoxx 50 on facebook, looking at the charts, you’ll notice that the FTSE is on a crazy rally that has broken above highs of the past 10 months, while the Eurostoxx 50 has only recovered a little more than 50% of the drop it experienced on Brexit results day.

I seldom look at the Europe equity markets, but this is something very obvious the moment I took a look at the FTSE. And I have to say, Price leads the way again.

Price formed a massive head and shoulders on a zone of interest. Call it support or call it demand, it’s up to you, but we can all see it’s an area of interest for the buyers. Best viewed on the weekly chart below.

And here’s the bullish inverted head and shoulders.

So we have a strong weekly close beyond the neckline of this inverted head and shoulders pattern. Is it the start of a new bullish wave to the upside? Classic technical analysis suggests that we will see 7350 sometime in the future. Do share your thoughts in the facebook group.

Is oil’s bull run coming to an end?

I wrote in a previous article here, that we would retrace back to the $46 on Crude light before a move higher. Price has dipped into exactly $46 twice since that post, and bounced up to $50 twice. It’s finding trouble breaking out of the range it’s in. Below it’s seeing some reaction from the 50 EMA, above it’s held down by USD strength and the $50 level.

While I am now less bullish than before with the scenario currently playing out on CL, the trend still seems intact to me. If another test of $46 doesn’t hold, $40 oil is on the charts. In the broader picture, we should still see oil prices move higher.

In the end, all that matters for you to make money from the market, is price movement. All the fundamental analysis or technical analysis, in the world could be pointing at a Sell, but if price doesn’t move down, you’re not going to make any money.

So listen for the directions that price tells you.

Good Trading Folks!

One Response

Comments are closed.