4 Tactics You Must Know To Counter & Survive A Recession

To most people, recessions are typically not good news. It tends to be accompanied by retrenchments or pay cuts.

But there are opportunities in difficult times, and savvy investors know this.

Recessions offer value for investors and higher volatility for traders to profit. It resets the cost of things so that we can start the next stage of growth.

So what can we do during a recession to turn challenge into opportunity?

Here are a few recession tactics you can use, but as always, do consult your professional financial planner before executing any plans. And ALWAYS do your own due diligence when it comes to your money.

#1 Dollar Cost Averaging

This is the most common strategy for long term investing.

You can do this on any market depending on your risk but an ETF which tracks a broad market index or even a group of indices would work well. The reason is simply for diversification and lower level of volatility and because we want to track the broad economic cycles.

If you have a view on a particular sector of the markets, for instance maybe you believe QE in Europe will boost the stock markets there then you can consider investing in an ETF which tracks the European equity markets. ETFs are very useful instruments, do some research on them.

#2 Your Job

This one is going to be a bit controversial but hear me out.

Do what you can to keep your job even if it means taking a pay cut. However, if you already have a stable side income or alternative skill which is monetizable it’s not the end of the world.

In fact it will be a fantastic opportunity to try to turn your side income into your main income. Scale up, devote more time to grow it.

If after 6 months it doesn’t seem feasible, get back into the job market. Employers are unlikely to fault you for being unemployed for a short period after being retrenched during a recession.

So during the good times, it’s always useful to develop alternative monetizable skills such as trading or teaching yoga or salsa.

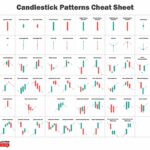

#3 Trading Opportunities

The high volatility generated from investor uncertainty during recession times are great for traders. To traders, more volatility means more opportunities. It’s okay to take smaller position sizes and use a wider stop loss to give the market space to move.

You take the same monetary risk per trade but chances are the volatility will give your winning trades a higher return as well.

If you have no time to trade, perhaps subscribing to a trading signal service or managed account service would work better for you. There are so many out there so do your own due diligence before committing any money though.

#4 Property Investment

This is a key market in our little island. Land here is scarce hence property prices can only go in one direction over the long term. Which is up.

Usually property prices get depressed during recessions. Generally private property prices lag the stock market by about 6 months. So keep your ears to the ground and look for good investment opportunities.

Likely many of you will be inexperienced in property investment, so it’s always good to learn and hear from experienced people who have done it before.

Stay safe everyone and good trading!